Hey there,

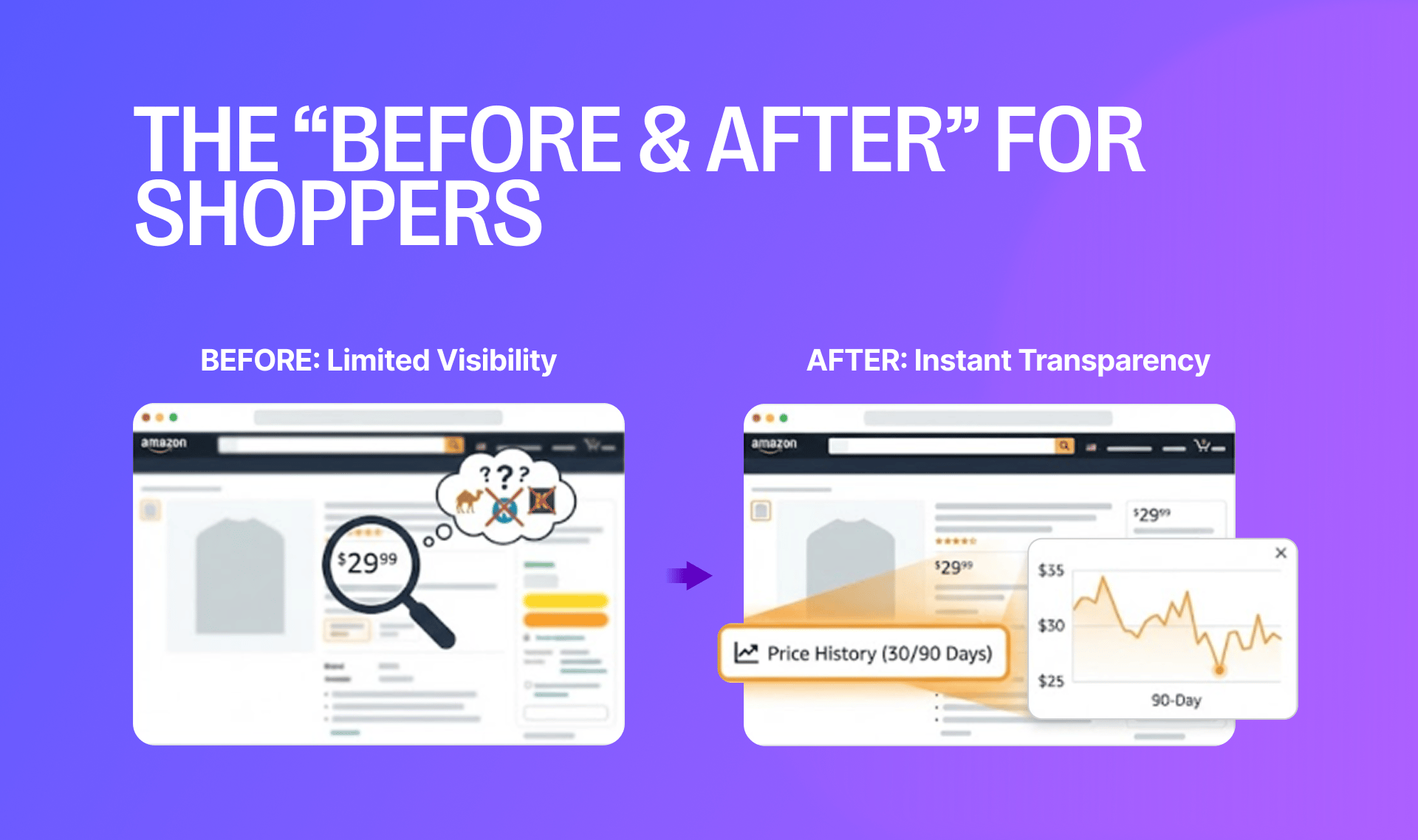

Amazon quietly rolled out a massive update to product detail pages – a native Price History feature that shows shoppers your pricing for the past 30 or 90 days.

At AO2, we’re already seeing pricing strategy become a conversion factor rather than a background detail as shoppers gain more visibility into historical pricing.

This is the first time Amazon has ever surfaced historical pricing to shoppers directly without requiring browser extensions like Keepa or CamelCamelCamel.

The button sits right below the current selling price. Click it and shoppers see a graph showing daily pricing over the selected timeframe, powered by Rufus.

This changes everything about how shoppers perceive deals and how brands must manage promotions, coupons, and pricing strategies going forward.

The feature appears on product detail pages below the current price. Shoppers can toggle between 30-day and 90-day views to see pricing trends.

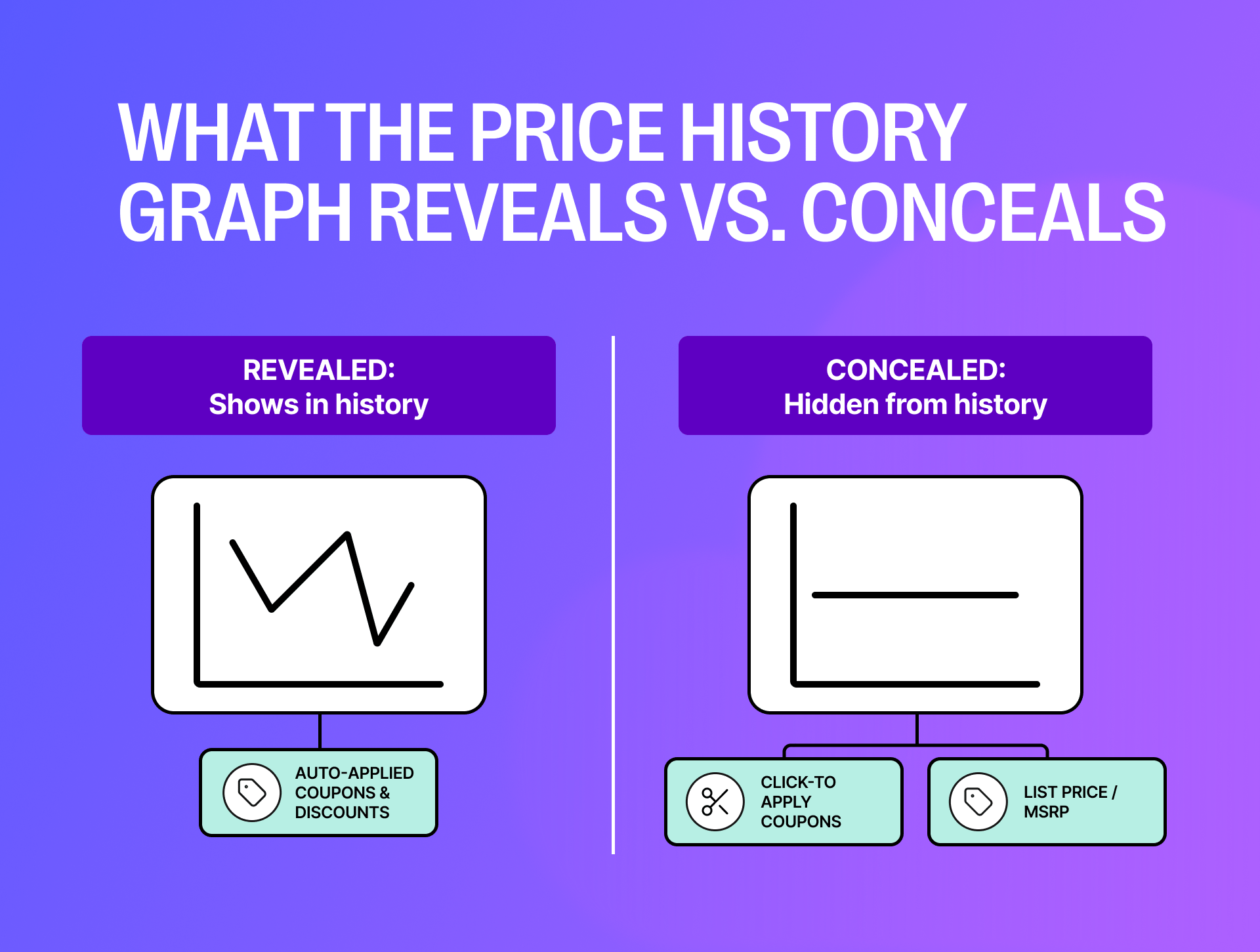

What it shows: The actual selling price, including automatically applied discounts. Historical daily pricing variations across the selected window.

What it doesn't show: Pricing beyond 90 days. Coupon availability unless the coupon auto-applies at checkout.

Amazon's official clarification states, "Price history typically shows the actual selling price, which includes active coupons or discounts that are automatically applied. If a coupon is available but not auto-applied, it may not appear in historical price tracking."

This distinction is going to confuse a lot of sellers. It also creates strategic opportunities for brands that understand the nuance.

Your pricing decisions that were previously invisible now directly influence shopper trust and conversion in real time:

A shopper looking at your product can see if you raised the price 2 weeks ago before running a "Sale"

They can see if your current price is actually the lowest it's been in 90 days or if it's just average

They can see if you run promotions every other week, which makes your regular price feel inflated

This changes the entire psychology of how deals get perceived and whether shoppers trust your brand enough to convert.

The timing isn't random. Several forces converged to make this update inevitable.

Amazon wants to build shopper trust in a post-inflation era where price sensitivity remains elevated. Transparent pricing reduces skepticism about whether deals are legitimate or manufactured.

Bad actors have been gaming strike-through pricing for years. Inflating list prices to make sale prices look better. Amazon wants to reduce these fake deal tactics without heavy-handed enforcement.

The FTC has increased scrutiny around pricing transparency and deceptive discounting practices. This update aligns Amazon with regulatory expectations before regulations force their hand.

Customer satisfaction during peak deal seasons like Prime Big Deal Days and BFCM improves when shoppers trust that promotions represent genuine value.

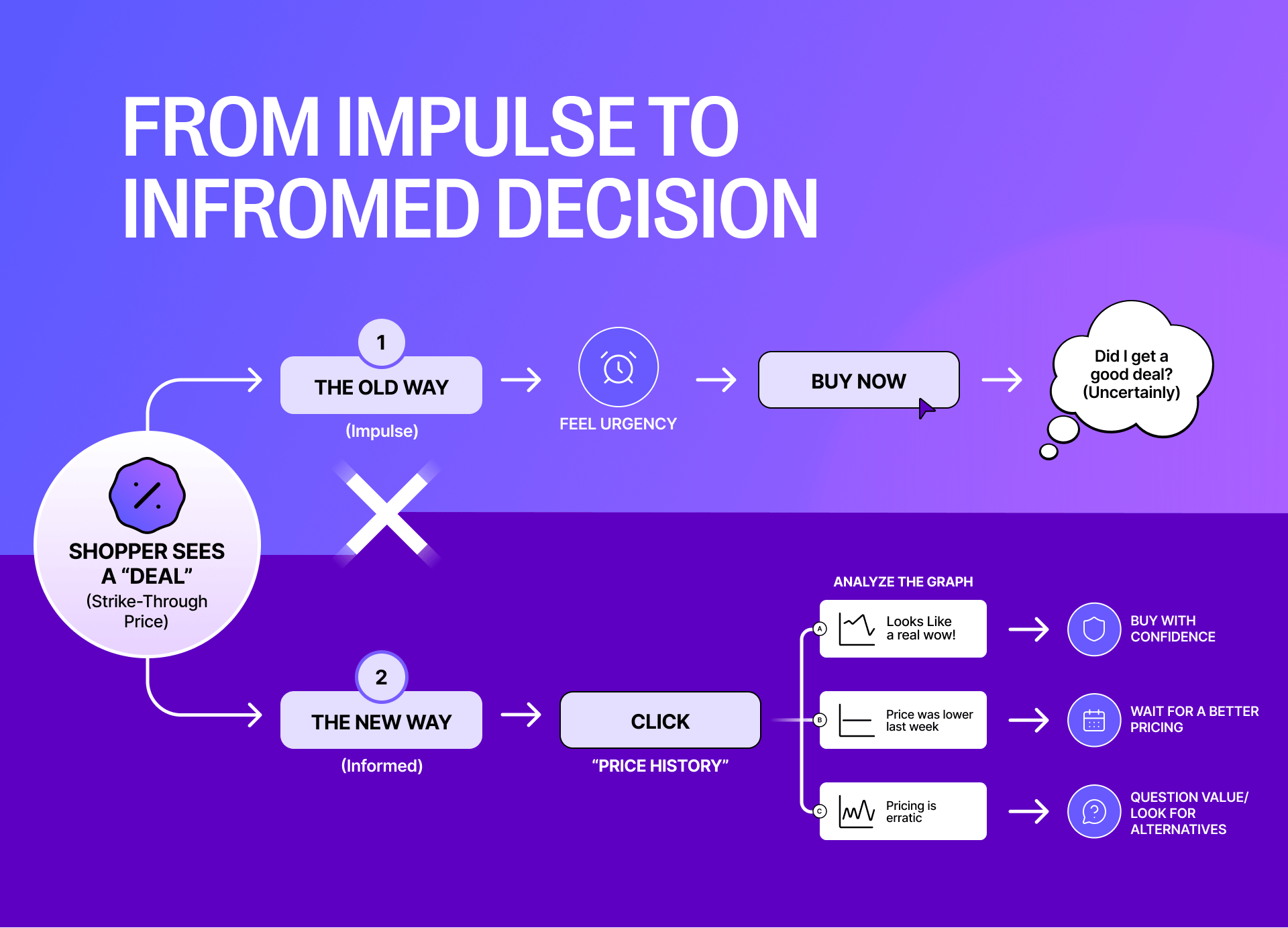

This feature moves shoppers from impulse driven decisions to pattern based decision making, where price consistency matters as much as price level.

When shoppers can see 90 days of pricing history with one click, several behavioral shifts happen immediately.

Shoppers will be less influenced by inflated markdowns

If shoppers can see that the "sale price" was actually the regular price last week, perceived deal value drops significantly. Strike-through pricing loses power when history reveals the pattern.

Coupon stacking becomes more strategic

Auto-applied coupons show in the price history. Clip-to-apply coupons do not. This creates room for creative promotional structuring where brands can offer value without impacting historical pricing perception.

Shoppers may delay or accelerate purchases based on visible patterns

People will now wait for 30-day or 90-day pricing lows. They'll identify typical promotional cycles and time purchases accordingly. Or they'll buy immediately if history shows prices rising.

Higher trust leads to higher conversion for honest brands

Brands with stable, consistent pricing strategies will benefit. Shoppers reward predictability and transparency with purchase confidence.

The net effect: educated shoppers make better decisions, which means brands need better strategies.

Simple manipulation tactics that worked when pricing was opaque will backfire when history is visible.

Transparency creates both risks and opportunities depending on how brands have been managing pricing.

Inconsistent pricing strategies get exposed publicly

Frequent price jumps create scrutiny. Shoppers question whether they're getting value or being manipulated through artificial urgency.

Deal planning must evolve with transparency in mind

Brands must consider whether a BFCM discount actually looks compelling given recent history. Whether coupons cannibalize sales by reducing perceived value in the graph. Whether weekly price changes confuse customers rather than create urgency.

MAP enforcement becomes more important than ever

Unauthorized sellers offering lower pricing damage your historical price chart. A graph showing wild fluctuations reduces brand credibility even if you're not controlling those prices.

Price increases will be noticed more quickly

But this is still better than going out of stock. Raising prices to manage low inventory is transparent but defensible. Going OOS completely removes you from consideration.

Content and reviews must carry more weight

If price isn't the primary differentiator because history reveals limited variation, content quality and review strength become the conversion drivers.

Pricing can no longer operate independently from content, promotions, and inventory management.

Everything needs to work together with transparency as a constraint.

The most immediate priority is understanding what your price history currently communicates to shoppers, followed by stabilizing pricing and adjusting coupon structure.

This helps brands know where to focus first.

Here’s a starter pack of 4 to-do(s) to walk you across this shift:

1. Review your 90-day pricing cadence immediately

Audit what your price history graph currently shows. Ensure promotions look meaningful rather than manipulative. Identify patterns that might confuse or frustrate shoppers.

2. Evaluate coupon strategy with the new visibility in mind

Shift some coupons from auto-applied to clip-to-apply if you want promotional flexibility without impacting price history graphs. Test different structures to find what drives conversion without creating perception problems.

3. Stabilize pricing leading into major promotional events

Erratic changes will backfire with visible history. Plan your pricing calendar with transparency as a design constraint rather than an afterthought.

4. Avoid raising price right before dropping a deal

This looks like artificial inflation when shoppers can see the full pattern. If you need to raise prices, do it well in advance of promotional periods or maintain consistency.

These aren't optional nice-to-haves.

Ignoring price history visibility will result in declining conversion as shoppers become more sophisticated about evaluating deal authenticity.

What if I run sales often? Will shoppers think my product is overpriced?

Only if sales are too frequent or inconsistent. Brands with smart promotional cadence (4 to 6 major events per year) are fine. The problem is weekly fluctuations without clear patterns.

Will the price history show my MSRP or List Price?

No. It shows the actual selling price that shoppers pay. List price manipulation doesn't impact what the graph displays.

Do coupons always appear in the history?

Only auto-applied coupons. Clip-to-apply coupons do not alter the historical graph. This creates strategic options for brands.

Does this hurt premium brands?

No. Premium brands actually benefit because they aren't relying on large markdowns to drive sales. Consistent pricing reinforces quality positioning.

Amazon is pushing the marketplace toward trust-first commerce. The days of gaming pricing perception through strike-through manipulation are ending.

Transparent pricing benefits brands who invest in strategy and stability. It punishes bad actors and inconsistent operators who rely on artificial urgency rather than genuine value.

This shift rewards agencies like AO2 who blend strategy, operations, and performance management. Quick tactical adjustments aren't enough. Brands need comprehensive pricing strategies that account for transparency as a permanent constraint.

The brands that adapt quickly will maintain conversion rates while building long-term customer trust. The brands that continue operating like price history is invisible will see declining performance as shoppers become more sophisticated about evaluating deals.

COMING NEXT WEEK:

The Amazon advertising audit framework that finds hidden budget waste in under an hour.

Jess

CEO, AO2

P.S. Have you checked what your 90-day price history currently shows shoppers? If you want AO2 to review your pricing structure or promotional cadence for 2025, reply to this email.

P.P.S. Catching up on recent issues? Read about Turkey 12's extended window and increased profitability.